In light of President Trump recently contracting the COVID-19 virus, many concerns and questions have been raised on whether or not the stock market would significantly rise or fall as an important actor of the market has been temporarily taken out of commission.

In the early stages of the pandemic, the stock market tanked to new lows, as expected, and in particular to the quarantine, the strange recovery of the market in recent times is peaking interests among economists. This unexpected recovery raises some questions on whether or not the president indeed has a large impact on the stock market itself and which will greatly affect the future for the American economy.

Starting from late February, the pandemic rendered the seemingly strong American economy into a market crash and from those moments forward, the American economy continued to steep downwards and lost more than forty percent. In as short as a few weeks, losses of trillions of dollars over market capitalization for many companies as a whole induced panic selling and speculation in response to the apparent financial crisis.

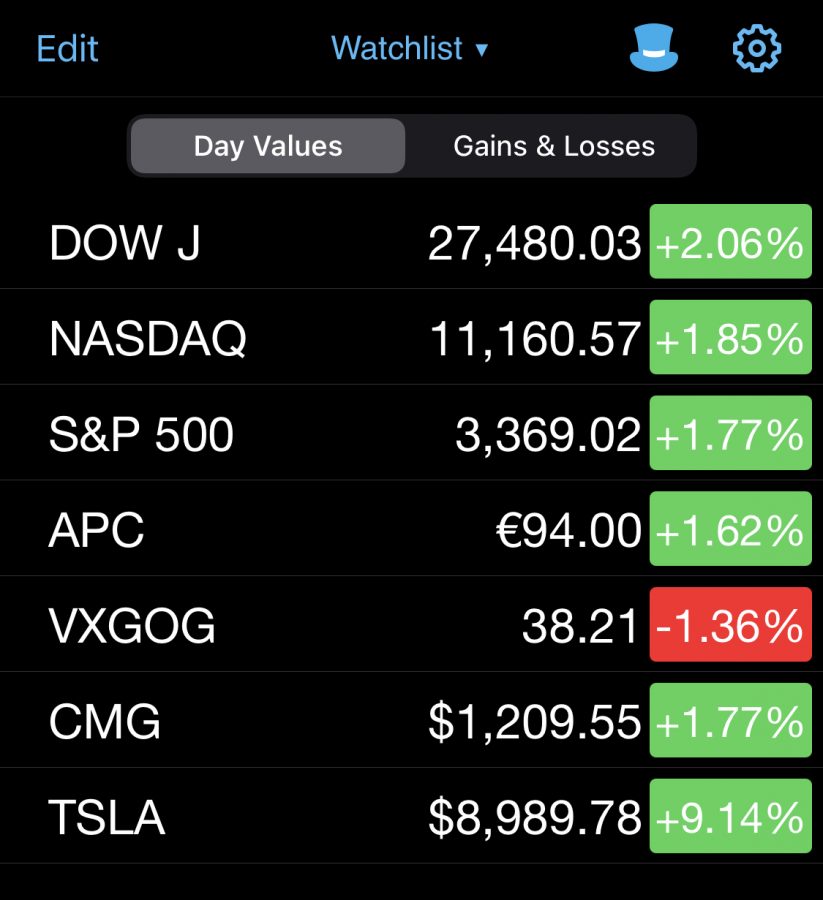

However, over the past eight months, as chaotic as the pandemic has been, the stock market has not only made a recovery but a comeback within a couple of months with one of the largest recovery rates in the history of the market. The market has not only recovered all the losses but also created a number of new historic highs.

Major stocks like S&P 500 are projected to continue to rise more than seven percent. The S&P 500 is a collective of the 500 largest publicly-traded companies in the United States, a key representation of how the US economy behaves.

One particular reason for the unexpected recovery is resultant of the Federal Reserve slashing interest rates to near-zero level and planning to maintain at such levels for a few years. The current administration also recently signed a two trillion dollar infrastructure package, provided a stimulus package to boost the economy, implemented a paycheck protection plan, directly purchased corporate bonds and ETF, and not only prevented the market from a further crash but also supported the market to recover.

Especially now, as we are deep into the election year, we have seen over the past eighty-seven years during election periods empirically, that regardless of which party won the presidency, the average annual return still mostly exceeded ten percent, a very significant attribute that carries through with today’s stock market. As quarter four in the fiscal year is closing in, the GDP is expected to show at least a thirty-five percent growth rate.

Although the market has been significantly impacted in the start of 2020, the economy is continuing to grow faster and does not display signs of losing momentum.